Self-Employed Tax Credit | FFCRA | ARPA

Discover if You Qualify for Up to $32,220

Express Refund in 5-7 Days!

April 15th Deadline – Don’t Miss Out!

Express Refund Is Live

Self-Employed Tax Credit (SETC) | Families First Coronavirus Response Act (FFCRA) | American Rescue Plan Act (ARPA)

Now accepting applications! Exciting news, our Express Funding Option is here. If you qualify, you could receive your SETC refund deposit in just 5 to 7 days with Express Funding for refunds exceeding $3,000.00.

✅ $0 Cost to Apply – Takes about 5 minutes

✅ Get Your Refund Estimate in about 15 minutes

✅ All Applications Processed – Express Funding available for refunds over $3,000.00

We have numerous testimonials from customers who had no idea they could retroactively receive an IRS refund for the Sick Leave Credit and Family Leave Credit under the FFCRA until they found us!

✅ Filed a 1040, Schedule C, or Schedule SE in 2021? – You may qualify Apply Now!

✅ Express Funding Option available – Receive your refund deposit in about 5-7 days if eligible

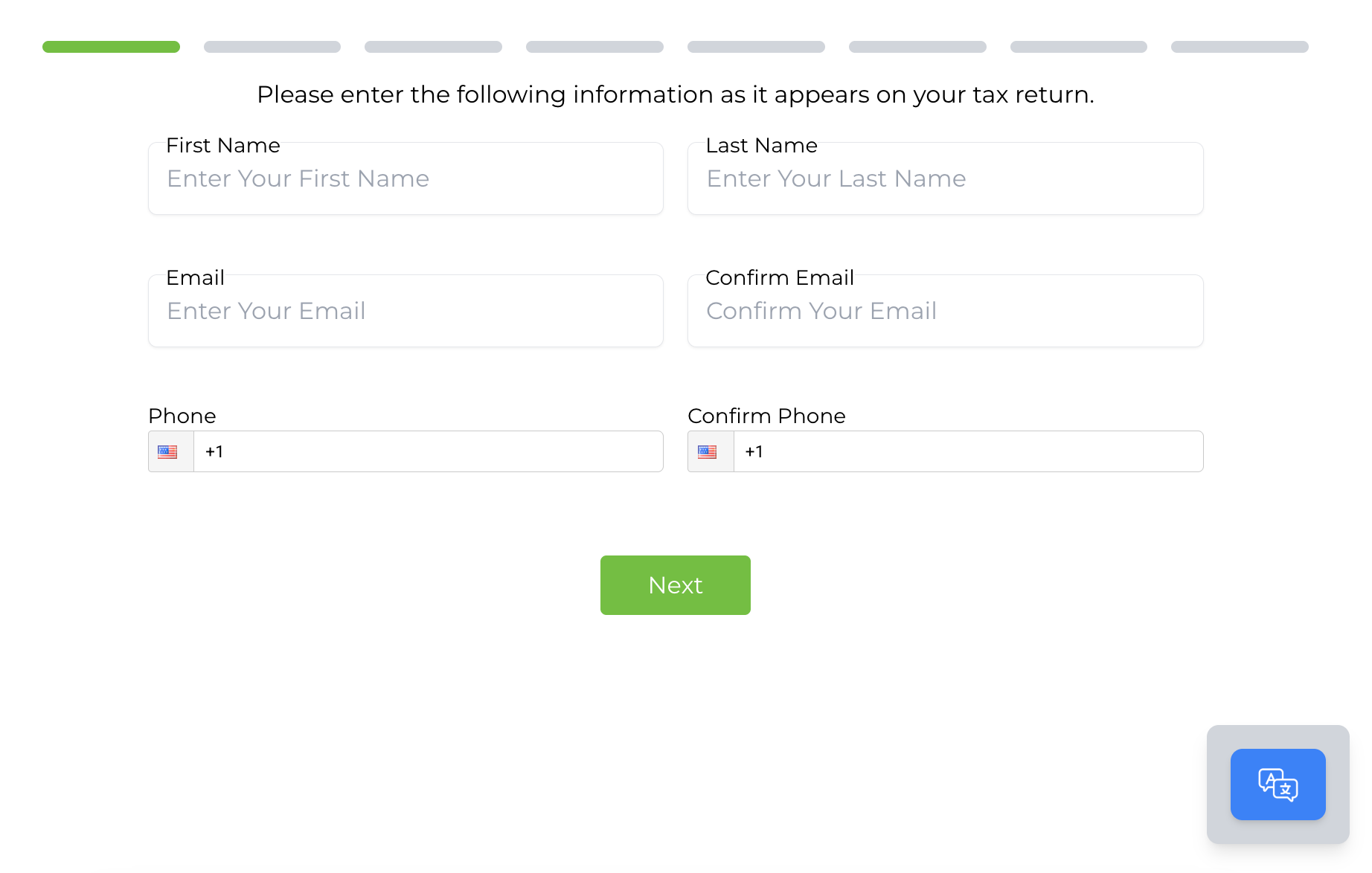

Let’s Check to See If You Qualify

If qualified, you are eligible for up to $32,220 in relief funds!

Understanding the Self-Employed Tax Credit (SETC)

No Cost to Apply

No Tax Form Uploads

Receive Refund

Did you know that the government has set aside billions in tax credits for self-employed individuals impacted by COVID-19 disruptions? In fact, an estimated $1,000,000,000 has already been paid to people just like you.

The SETC Program offers financial relief to those affected by the pandemic. The specific name of these historic tax credits are the Credits for Sick and Family Leave, as outlined in the Families First Coronavirus Response Act (FFCRA) and the American Rescue Plan Act (ARPA).

Every person with positive self-employment earnings in tax year 2021 (including 1099 contractors) impacted by COVID-19, is eligible. Professions like realtors, stylists, construction trades, gig workers, freelancers, entrepreneurs, and more were some of the hardest hit, with over 40 million Americans qualifying.

It’s FREE and confidential to apply. With SETC Pros, there’s no need for uploading old tax documents to claim your credit. Best of all, the IRS pays an additional estimated 16% in interest to the quote we prepare for you!

Act now before time runs out! This historic program ends on April 15, 2025.

Minimum Requirements

People care

Who Qualifies

About 30 to 50+ Million People Are Eligible

- Single Member LLCs

- Independent Contractors

- Sole Proprietors

- Freelancers

- Gig Workers

- Beauty Industry Professionals

- Construction Trades

- Realtors

- Uber/Lift Drivers

- And Many More

Qualifying Events

If you were self-employed and unable to work due to any of the following:

- Diagnosed with COVID-19?

- Cared for a family member?Unable to go to work or telework?

- Government shutdowns?

- School/childcare closures?

- Forced quarantine?

- Related symptoms?

Eligibility

The following conditions apply:

- Must have been self-employed in 2021 and receiving 1099 / Schedule C income

- Must have experienced a qualified COVID-19 disruption (impacted)

- Must have self-employment earnings in 2021(Unsure? It's free to check)

- S-Corps, C-Corps, and W-2 income are not eligible

Why Choose SETC Pros?

Expert Guidance, Every Step of the Way

Our team of tax credit specialists is dedicated to making your experience seamless. From your initial eligibility check to receiving your refund, we're here to answer your questions and provide personalized support. Have a question? Don't hesitate to reach out!

Industry-Leading Innovation

Our proprietary technology, developed by tax experts, revolutionizes the way self-employed individuals claim their tax credits. No more confusion or paperwork. Check your eligibility for free and see how much you could be owed.

Proven Track Record of Success

Since the pandemic, our mission has been to ensure self-employed individuals receive the financial support they deserve. Our team of experts has successfully secured $100,000,000 in tax refunds, and we're ready to help you claim your share.

What They Say About Us?

TestimonialS

Explore the success stories of individuals who entrusted SETC Pros for their Self-Employed Tax Credits—real experiences that highlight our commitment to delivering exceptional service and maximizing financial benefits.

SETC Pros in the News

Catch us in the news as we highlight how millions are missing out on valuable tax credits.

Zero-Risk Guarantee

We are dedicated to providing exceptional service to ensure you get the tax credit refund you’re entitled to. In the rare event that we can’t secure your refund, rest assured you won’t face any financial burden. We take on all the risk. There is never a fee unless we recover money for you!

Frequently Asked Questions

Here are ten of the most popular questions clients ask us about the Self-Employed Tax Credit. If you have a specific question in mind, please do not hesitate to contact us below.

How does the EXPRESS FUNDING OPTION work?

When you select the "Express Refund" option, you will verify some additional information with the bank. Once that’s complete, you simply sign and mail your complete packet, along with your SETC Pros Customer Bar Code (provided with packet) to our processing center in Roseville, CA. A pre-paid shipping label is provided for you in your customer portal.

After your file is reviewed for accuracy, we ship all necessary documents to various IRS locations. Once all packages are delivered to the IRS, our banking partner sends your funds to your selected bank account by ACH transfer. Typically, the entire process can be completed in about 5-7 business days.

Normal IRS wait times are 16-20 weeks or longer. This option gives you the opportunity to put the majority of your refund in your pocket in a matter of days.

How do I check my application status?

To check the status of your application and see live updates, simply visit your customer portal at https://myportal.setcpros.com.

In the portal, you can track your application’s progress in real-time. If you have any questions or need further assistance, feel free to reach out to us at support@setcpros.com. We’re here to help every step of the way!

Why is my file status “Do Not Qualify”?

Your file status shows "Do Not Qualify" because, based on the IRS transcripts we received, you don't meet the requirements for the Sick Leave Credit for 2021. This could be due to a few reasons:

- You didn’t have any self-employment income in 2021.

- The credit has already been claimed.

- No return was filed for 2021.

We’ve sent you an email specifying which of these reasons applies to your situation. According to IRS regulations, you don’t qualify for the Sick Leave or Family Leave Credit for 2021. Our program works in conjunction with the tax transcripts on file with the IRS.

We recommend consulting with a tax professional for further clarification. Thank you for applying with SETC Pros!

Why is there no information in the “prepared by” section with signature required?

The "Prepared By" section with the signature required is left blank because the calculations for the Sick Leave and Family Leave Credit are performed by our proprietary software. Our software is designed to accurately calculate and maximize your SETC refund, following all IRS rules for qualifying and claiming these credits. To ensure accuracy, our Chief CPA randomly audits files to verify that the software is optimizing refunds for every applicant.

Similar to how TurboTax provides software to help individuals with tax return calculations, we are a software-based company assisting clients with calculations for amended returns. According to IRS guidelines, it would be incorrect for us to sign as an individual preparer, just as TurboTax does not sign returns that their software assists with.

Once you sign and mail your amended return, if the IRS has any questions or needs additional information to process your claim, SETC Pros will continue assisting you throughout the process. If your file requires review by a CPA or enrolled agent, it will be escalated to the appropriate channels.

Can I Still Claim the 2020 Tax Credit or is this just for 2021?

The system will automatically maximize your 2021 refund amount. In some cases, clients may also qualify for certain 2020 benefits based on missed workdays due to COVID-19. The system will automatically calculate and maximize your benefit for both 2021 and any applicable carry-forward from 2020. All you need to do is complete the application, and we will handle the rest to ensure you receive the maximum benefit possible.

I was Married Filing Jointly (MFJ) in 2021 but am divorced now. Do I still need my former spouse’s info & signature on the 1040 & 1040x for the SETC refund?

Yes, if you filed as Married Filing Jointly (MFJ) in 2021, both you and your former spouse must sign the current 1040 and 1040X forms for the SETC refund, even if you are now divorced or separated.

If your former spouse is deceased, you may need to include a copy of their death certificate when mailing the final documents to the IRS.

I received an IRS LETTER requesting a follow up… What should I do?

If you received a letter from the IRS asking you to call them, please reach out to the IRS as soon as possible. Typically, the IRS will need to verify your identity or address in order to complete the processing of your Sick Leave and Family Leave Credit refund.

Taking action quickly will help ensure your claim is processed without further delay.

The IRS Link is not showing my claim being processed… What should I do?

If the IRS link is not showing your claim as being processed, don't worry — this can happen. Many of our clients who submitted both their 2020 and 2021 amended returns in separate envelopes have reported that the 2021 return shows as being processed, but the 2020 return can take over 16 weeks to even appear as "in process."

In many cases, the IRS will send a letter after 16 weeks, either to verify your address for sending your refund check or to confirm your identity.

If you don't see your 2020 return being processed, it's important to call the IRS immediately to ensure there are no issues delaying your refund. You can reach an IRS live agent at 800-829-1040 or use their automated system at 866-464-2050.

If you've already called the IRS and they reported "No 2020 docs received," please let us know so we can escalate your case for further review.

I received an IRS letter requesting additional documentation or resubmission… What should I do?

If you've received an IRS letter requesting additional documentation or a resubmission, please email a copy of that letter to support@setcpros.com. Once we receive it, our team will review the letter and promptly notify you of the next steps to complete the process.

Please make sure to forward any IRS letter requesting additional documentation to support@setcpros.com so we can assist you efficiently.

SETC Pros charged the processing fee, but my IRS refund has not been received yet… Why is this?

If your IRS refund has not been received yet, but the transcript shows that the IRS issued payment, we recommend checking both your bank statements and your mail. The IRS may have either directly deposited your refund into your account or mailed you a paper check.

If you can't locate the refund, you can also call the IRS at 1-800-829-1040 for further assistance.

Once you’ve checked your bank statement and contacted the IRS if needed, please feel free to reach out to us again for further support. The processing fee was debited after the IRS payout was issued according to the transcript.

What is Form 8821?

Form 8821 is a form used by our partner, Chart, to officially request tax transcripts from the IRS. SETC Pros does not send this form to the client or the IRS.

Only Chart sends Form 8821 directly to the IRS for requesting transcripts. The forms that SETC Pros provides to clients are related to the 2021 amendment process, which include the 1040-X, 1040, Schedule 3, and Form 7202.

Additionally, SETC Pros provides Form 8888, which specifies the account for the IRS to deposit your refund.

Why is the Routing & Account # on the form 8888 not my account info?

Form 8888 tells the IRS where to deposit your refund. For clients using Chase Bank or PNC Bank, after entering your routing and account number on Form 8888 and printing it, the form will not display your actual account information. Instead, it will show a "tokenized" routing and account number.

This "tokenized" number is encrypted for your security and privacy. If you are using Chase or PNC Bank, the routing and account number shown on the printed Form 8888 is tokenized. You can contact your bank (Chase or PNC) to confirm the correct routing and account information.

I read an IRS Consumer Alert about The Self-Employed Tax Credit… Is this a scam?

The IRS stated that “Self-Employed Tax Credit” is not the official name of the program. Instead, it is an industry term used to describe the program, which is officially known as the Sick Leave Tax Credit (for self-employed individuals) and the Family Sick Leave Tax Credit. On the SETC Pros intake page, you will only see questions related to these two categories—Sick Leave Tax Credit and Family Sick Leave Tax Credit.

The IRS also warned about scammers filling out tax documents for individuals who do not qualify, and charging a fee. At SETC Pros, we never charge a fee to qualify clients. We inform you upfront about how much you qualify for, and we only qualify individuals who had self-employment income in 2021. Additionally, we only use IRS-provided transcripts, ensuring that only those who meet the IRS guidelines for self-employment income and missed workdays due to COVID-19 qualify for the credit.

Another concern was scammers applying for the wrong tax year. At SETC Pros, we focus solely on 2021 applications, as outlined by the IRS.

Rest assured, when you apply with SETC Pros, we will only perform calculations and qualify you for a refund if you meet the specific criteria set by the IRS.

Do you have any other questions? Feel free to check your Customer Portal for updates, and don’t hesitate to call us if you need assistance.